While reserves in 2012 were marginally added, production continues to decline significantly from last two years. Investment, as predicted, has risen to new high levels to support additional reserves and to exploit field allowances.

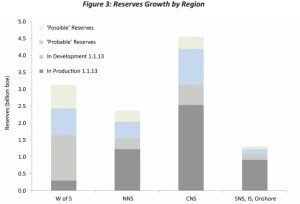

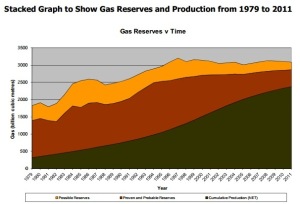

UK Oil and Gas reported 3,098 mmbbls of proven reserves as of 31st December 2011. In 2012, 10 billion boe mid case are anticipated to be recovered from reported reserve base. Proven reserves in existing field and fields under development have significantly risen to 7.4 boe as compared with 7.1 in 2011, reflecting current wave of investment. However, in another category possible reserve (<P50) base, from 7 discoveries, has marginally fallen by 0.4 boe. The decline in possible reserves suggests pursuing exploration using enhanced techniques. Average size of discoveries has been around 30 million boe over the last decade.

Source: UK Oil and Gas activity survey 2013

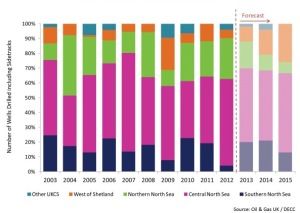

Among UKCS, the most promising region has been CNS in terms of adding probable resources and resources moved to development stage. Access to extensive UKCS infrastructure means the previously uneconomical discoveries are now being commercialised. New potentially commercial fields accounts for 2.9 billion boe of recoverable reserves with 23 in central North Sea (CNS) and 13 in northern North Sea (NNS). Half of these fields have typical size of 20 million boe, highlighting ever increasing opportunity for investment in CNS and NNS infrastructure. Exploration drilling is expected to hit 35-40 wells in 2013. E&A drilling in 2012 resulted in expenditure of £1.4b with CNS seeing majority of the activity.

Source: DECC

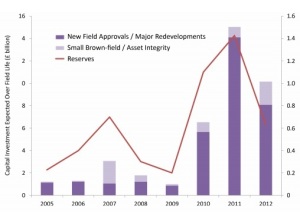

Investment is currently seeing a surge in UK continental shelf, highest since last three decades. Investment capital is expected to rise from £11.4b in 2012 to £13b in 2013 dedicated to new developments, existing and expansions. £44b is currently under sanctioned for investment in the UKCS. Whilst investment has peaked at £13b in 2013, highest in more than three decades; Operating expenditure (opex) for producing a barrel has sharply increased to five times from 2003 levels.

Source: DECC, Oil and Gas UK

This simply means the eminence of North Sea energy continues to increase in increasingly scarce domestic market. Also, the move from promoting exploration in the region has given way to development based activities and asset integrity work over the course of successfully managing to extract what is currently known. Overall operating cost is expected to rise to £8.3b in 2013. This reflects the rapidly rising cost of operating on UKCS, improving asset performance and cost of securing infrastructure in increasingly tighter market. One of the key issues in the UKCS industry is around challenges of bringing together the resources to capitalise on the marginal size of fields and making them commercial. This underlying trend in the industry is bound to promote next wave of asset collaboration. The overall investment suggests an improving outlook for drilling activities and easing access to finance for smaller to mid-cap companies. Increasing risk appetite has led the smaller players to have more access to market capital and availability of cash to fund developments and asset integrity work. UK oil and gas has pointed that it made sense for the UK government to support the developments as it will eventually benefit the public.

Associated reserves and CAPEX from new field reserves

Source-DECC, Oil and gas UK

Nearly £22b will be invested in developing a chunk of 3098 mmbbls of overall proven reserves base; this means production will rise quickly in next coming years by 2017 considering average development periods for the current fields.

Capital injection is expected to steadily increase for 2013-2015 period following approval of small fields and introduction of brown field allowances. The majority of this capital was allocated for new developments and redevelopments. Current trend, as such, of investment is supported by increased oil prices which averaged at $110 in 2012. However, an interesting trend is that the investment increased by only two times despite trebling of oil prices over 2002-2003 level. The continued uncertainty over tax regime forced investors to withhold projects until some certainty was provided by introducing brown field allowances for some of the key projects. In light of recent field allowances, GDF E&P UK moved Cygnus to development stage committing £1.4 bn which is anticipated to start producing in 2015. New investment promises to add a third of current production to UKCS portfolio by 2017 and generate £25b in corporation taxes further benefiting the balance of payment. Budget announced on 20th March 2013 has promised to provide a certainty for decommissioning, which is geared towards encouraging smaller companies to move developments and speed up the recovery process. It further aims to provide a substantial tax relief to offset the cost of decommissioning further in life cycle.